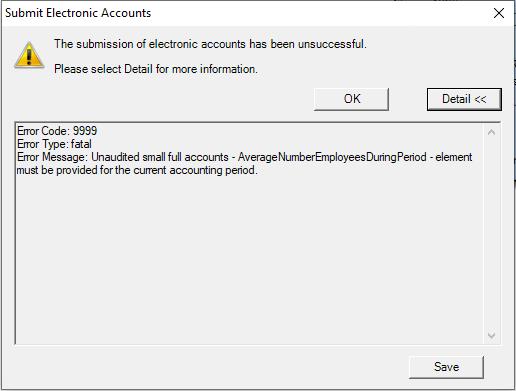

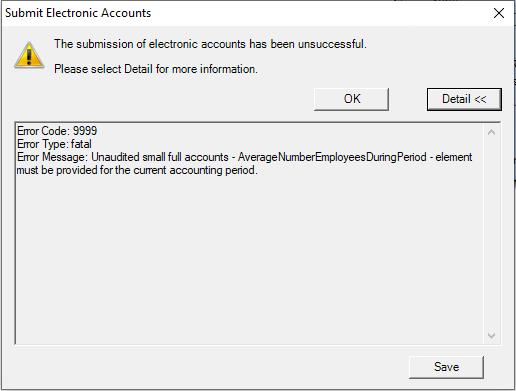

You may have encountered an error indicating an error in the company’s internal accounts. Well, there are several ways to solve this problem, and we will come back to this in a bit.

Approved: Fortect

You should email your accountant to notify him of this error and to make sure he is promptly filling out the correct version of the invoices. Your next step is to contact Companies House and ask them to retrieve the inappropriate invoices.

You will be subject to penalties if you do not submit your accounts to Companies House by the due date. Penalties for limited decision makers vary. You will automatically receive a fine notification if your reports are submitted on time. The penalty is doubled if your accounts are overdue for 2 consecutive years.

Recently I Have Published Several Articles On The Benefits Of Providing Reliable Information To Companies House. We Will Not Blame You For The Fact That We Are Just Lawyers And Legal Representatives, And It Is Natural For Us To Be Pedantic.tic. To Be Honest, We’d Rather It Be.

Unfortunately, my wife and I regularly see the detrimental effect of the wrong commercial registry on a business, not only in terms of cost, but also in terms of confusing opportunities. For obvious reasons, we cannot list all companies, instead we will refer to a few of our examples such as Lily Limited, Carnation Limited, Honeysuckle Limited and Foxglove Limited – for the reason that roses by any other name would also smell bittersweet in this unit…

How do I remove an incorrect file from Companies House?

Correct information provided in accordance with Companies House procedures. There should be two such procedures.Another option is to ask the court for a bill in accordance with the provisions of section ten of the Companies Act 2006.

How To Submit Your Accounts

The fastest and most convenient way to submit your accounts is via. Once you’ve decided on the format of the accounts to submit, your entire family can follow the online instructions or watch our YouTube tutorial videos to learn how.

Why do accounts get rejected by Companies House?

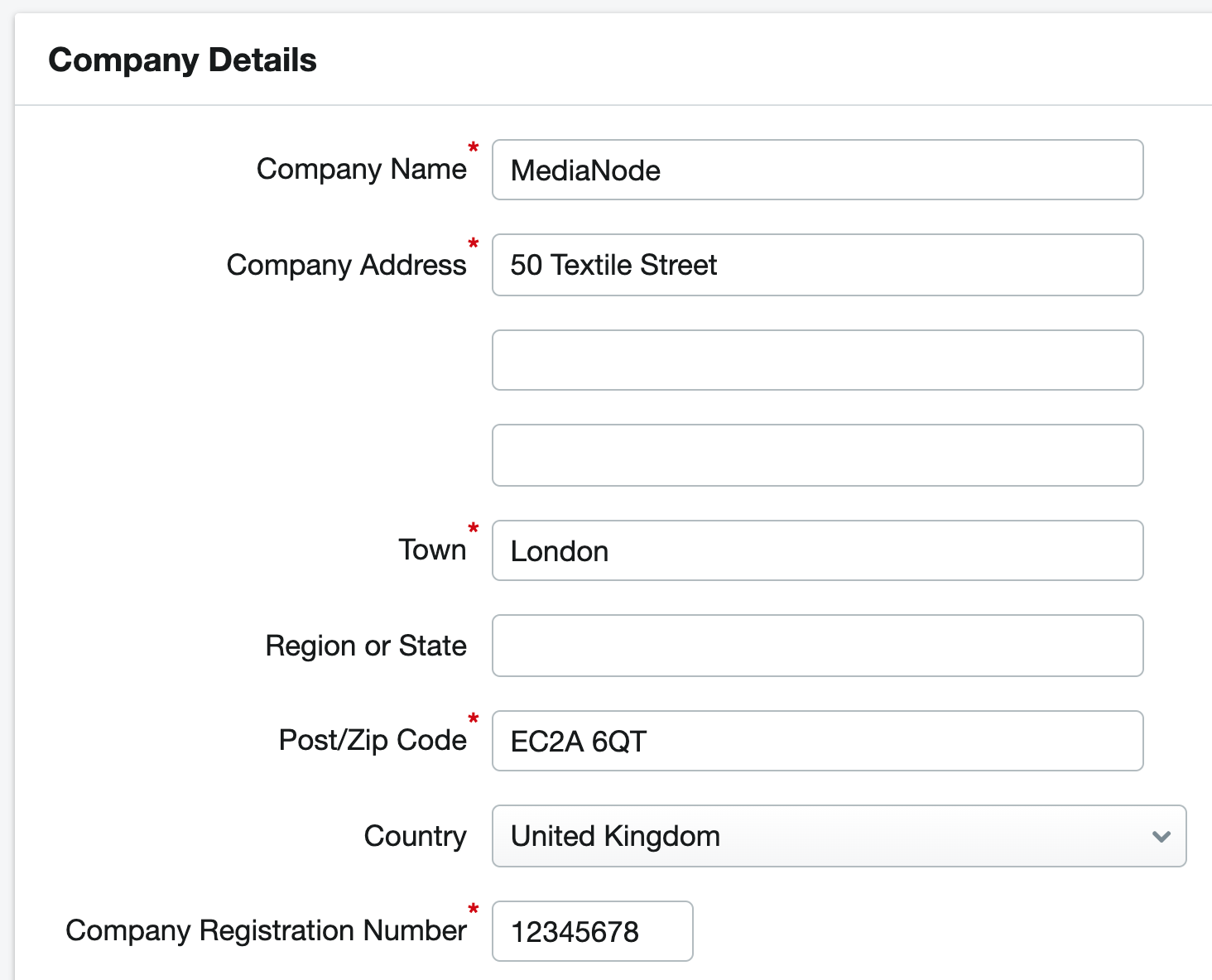

One of the main reasons accounts do get rejected is because the company name or number is missing, incorrect, little or inconsistent. The company name and registration number provided statewide must match and exactly match those found in Companies House records.

Financial Application Errors Small Limited Liability Companies

The errors highlighted below apply to all limited liability companies, which are simply considered small companies because of this. Typically, small companiesand have a turnover of less than £10.2m. For my complete guide, see the “Small Business Restrictions” section on my personal blog.

What Happens When Accounts Are Rejected?

If your favorite accounts don’t meet the requirements of Companies House, they will be returned to you if it comes to a fix. It is advisable to receive Companies House reports well in advance of the filing deadline, as you will not be given additional time if they are rejected beyond a reasonable doubt.

Can accounts be removed from Companies House?

Seizure of documents from Companies House – court order A court order may remove any paper copies, invoices, or other defective items from a consumer’s medical history. The order itself will remain saved, and it will indicate which paper copy was deleted, but not necessarily why.

Then – Do I Use WebFiling To File My Financial Statements?

WebFiling allows you to file AA02 Condensed Inactive Corporate Financial Statements (DCA), Condensed Audit Exempt Financial Statements, and Complete Audit Exempt Financial Statements. These invoices should be more accurate copies of the invoices normally approved and signed on behalf of the organization’s board of directors.

When do companies have to report accounts to Companies House?

The company must submit eligible items by June 30, 2020 to avoid late filing penalties. If they are not delivered to Companies House by July 15, 2020, the workplace will be fined £ 150. If the company also provides new accounts for the next period before September 40, 2020, it faces a £ 300 fine for late filing.

How do I correct my accounts for Companies House submission?

To give Companies House time to correct your deposit accounts, simply go to the Client / Ads / Parents tab and delete the time period for administrators. Finally, create an IXBRL and submit it. 2. This error is largely due to the fact that the communication between IRIS and Companies House servers is simply busy.

How do you correct a filing error on Companies House?

If you find a problem with one of the documents listed below that has already been uploaded to Companies House’s registry, you can correct it on Form RP04. You can file your company’s RP04 if you are registered with the Companies House Web Registration Service, but if you are unable to do so, here are the steps to file your RP04:

Can you amend accounts on Companies House?

Accounts can be submitted to Companies House through the Review and Submit tab on any account creation page.